City of Calgary property tax hikes on businesses of 40% and more are driving some to go out of business, while others fear they might be next.

Escoba Bistro and Wine Bar has been in business for 20 years, a real feat in an industry that often sees quick turnover. But now the restaurant is going out of business, not because of anything the owners did, but because of massive tax hikes.

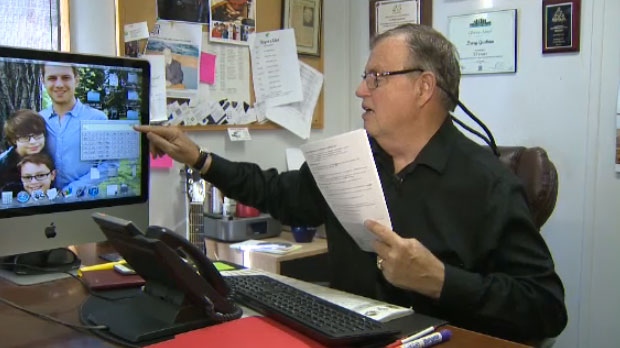

“In 2015, my property taxes were increased by almost double, I had a $32,000 in 2014, it went up to $67,000,” said Darren Hamelin, owner.

He appealed that hike and won, but the cost of the appeal was $14,000. Then this year, he got a $60,000 tax bill again and decided he could no longer fight city hall.

“My story is not unique, there are going to be people following me into bankruptcy and closing their doors because all the nails are in the coffin, you have increased payroll, increased payroll taxes, increased income taxes,” he said, and pointed to rising food costs and the upcoming carbon tax as further problems he can’t overcome.

The owner of Graham Auctions agrees that the tax hikes are too severe. Even though the company isn’t shutting down, it will suffer under the tax increases.

“In 2015, our taxes were $44,400 to the city and $14,000 (to the province) which comes to $58,000 total,” said Larry Graham. “The total assessment now went up $20,000 more, so it comes to almost $79,000…. They have gone up 50% in a year and a half!”

Graham says the city has done nothing over the years to help improve his property, and forbids him to subdivide the large property in order to be more cost-effective.

The number of companies appealing their assessments rose to just over 3100 this year, up from about 2700 last year.