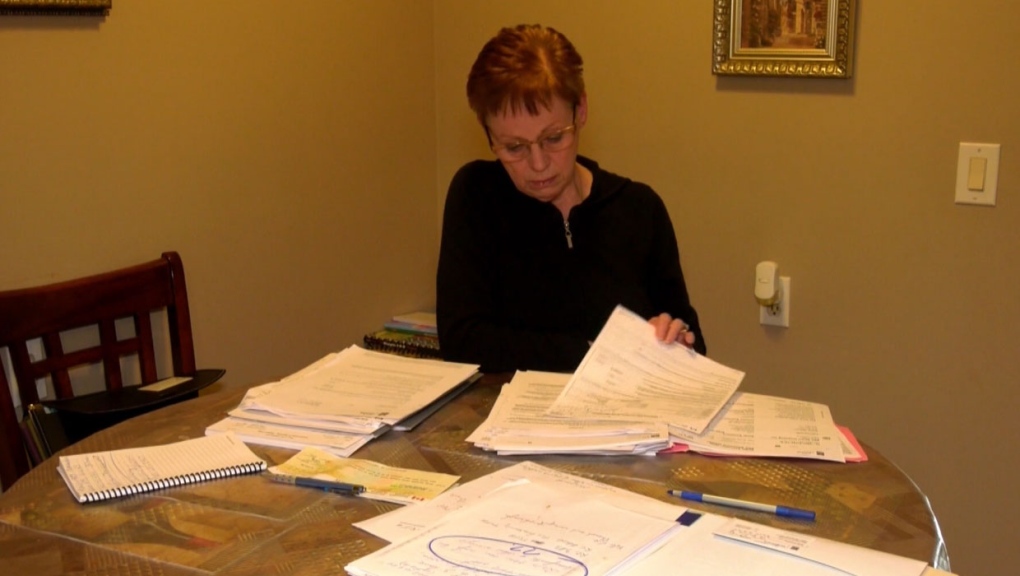

CALGARY -- It’s taken three years, but a Calgary widow facing a massive tax bill to the Canada Revenue Agency, said the charges have finally been reversed.

Donna Phillips said she is relieved the financial ordeal, that began when she lost her husband Jim in Aug. 2017, is over.

In January, Phillips told CTV News she was slammed with a tax bill when she tried to transfer savings from her husband's account into her own. She said she was told she had to pay nearly 50 per cent tax on her husband’s estate to CRA.

The problem was Phillips wasn’t named as a beneficiary on new paperwork that was written up prior to her husband's death. When her husband turned 71, it was required he convert money in his RSP, retirement savings plan, into a RIF. She said somehow her name was left off the paperwork.

Phillips spoke out to warn other couples to make sure they are educated about their spouse's finances.

Now she said the tax bill has been reversed and her bank, RBC, also reversed $12,000 interest on a loan she had to take on her home to pay the bill.