Alberta's auto insurance changes set to impact premium calculations and claims process in 2022

More mandatory changes are coming to Alberta's auto insurance policies in the new year.

Starting Jan. 1, the province will be adopting a direct compensation for property damage model, more commonly known as DCPD.

For drivers not at fault in a collision, DCPD will push the onus of vehicle assessment and repair to their own insurance provider.

It's meant to speed up a complicated, sometimes arduous process.

"It's really just a streamlining process for how a claim is handled moving forward," Jaime Tempeny with Westland Insurance said. "So rather than chasing third party carriers and adjusters, you're now dealing with the insurance carrier that you hired."

Alberta is the last province to jump on board with the model.

COSTS TO STAY THE SAME

But many are likely only focused on one thing when it comes to auto insurance: price.

Aaron Sutherland with the Insurance Bureau of Canada says for most drivers, costs will likely stay relatively consistent.

"What's coming in to insurers as a result of this change has to be revenue neutral, so there's no overall rate increase here," he told CTV News. "(Providers) can now better align your premiums with your vehicle. So what that means is if you drive a less expensive vehicle that costs less to repair, you will be paying less under DCPD. And at the same time, if you drive a more expensive vehicle that costs a little bit more to repair, you're going to pay a little bit more. But that's a fair system."

According to the Alberta Automobile Insurance Rate Board, it's estimated about 42 per cent of Alberta drivers will see premium reductions. 15 per cent won't notice a change and 43 per cent of drivers will see increases.

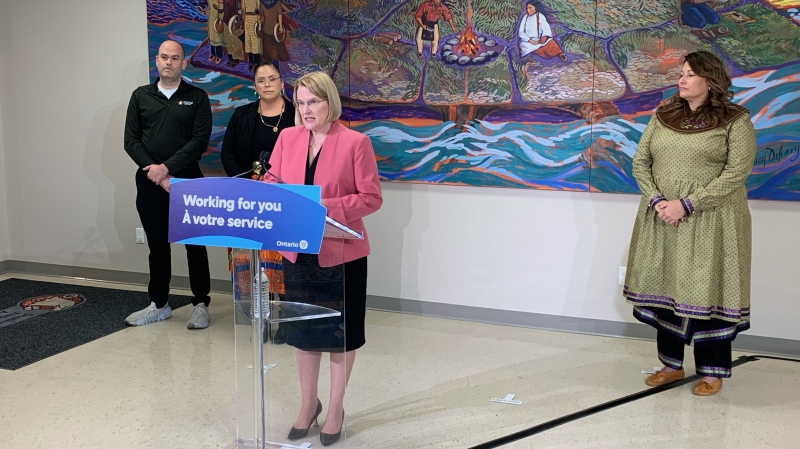

Finance Minister Travis Toews refused an interview request, but sent a statement saying under DCPD, drivers can "expect a more consistent treatment and quicker response on claims from insurers."

The changes will not have any bearing on the benefits drivers receive to recover physically after a collision, or the ability of Albertans to pursue legal action after a crash.

DCPD does not cover damage from an uninsured vehicle.

CTVNews.ca Top Stories

BREAKING Israel attacks Iran, Reuters sources say; drones reported over Isfahan

Israel has attacked Iran, three people familiar with the matter told Reuters, as Iranian state media reported early on Friday that its forces had destroyed drones, days after Iran launched a retaliatory drone strike on Israel.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.