Alberta's unemployment rate jumps yet hospitality faces staffing challenges

Rising unemployment is a sign the economy is starting to cool off amid efforts to rein in inflation, while Alberta's hospitality sector struggles to fill open positions.

Teatro Group officials say there are open positions in management, front-of-house and in the kitchen at all seven of its Calgary locations.

"There's definitely a shortage of people who are coming through the front door looking to work in hospitality," said Matthew Batey, chief operating officer for Teatro Group.

"It is very curious that the (un)employment rate is continuing to increase yet hospitality continues to struggle, but I think it's a bit of a lagging indicator. As the unemployment rate goes up, some of that correction will happen in a month or so in hospitality."

Batey says the company is equally focused on recruitment and employee retention, but strengthening the dining experience for guests is the best way the group hopes to manage ongoing economic uncertainty.

ALBERTA'S JOBLESS RATE CLIMBS

There's a growing pool of job-seekers in Alberta.

Alberta's unemployment rate spiked in August, but jobless rates in both Calgary and Edmonton remained largely unchanged.

According to Statistics Canada’s August 2022 Labour Force Survey, Alberta had an unemployment rate of 5.4 per cent last month, up from July when it sat at 4.8 per cent.

Statistics Canada noted that Alberta, along with Manitoba, had the youngest employed population in Canada, as younger workers outnumbered older workers by approximately six to five (not seasonally adjusted).

In Calgary, unemployment fell slightly to 4.9 per cent in August from five per cent the month before.

The last year unemployment in Calgary was under 5.0 per cent was 2014. Unemployment peaked at 15.4 per cent in June 2020.

"Our unemployment rate has reached levels last seen during the peak of Calgary’s energy boom," said Calgary Economic Development spokesperson Dexter Lam.

"While this may appear welcome after years of labour market uncertainty related to energy sector volatility and COVID-19, such tight labor market conditions do complicate the near-term outlook in the face of inflation and potential recessionary pressures."

INFLATION AND HOUSEHOLDS

To cool inflation, the Bank of Canada continues to increase the key interest rate, which now rests at 3.25 per cent.

"There's just too much stimulus in the economy right now in the eyes of the Bank of Canada, and for that reason they want to damper demand," said Trent Hamans, vice-president of private banking and wealth management.

He says it means Alberta households should take steps to prepare for economic volatility.

"We talk to clients about managing what they can control," said Hamans.

"(We ask) what is their savings rate? What is their debt management ratio."

UNEMPLOYMENT DIPS

Edmonton's unemployment rate also dipped to 4.9 per cent in August, compared to 5.1 per cent in July.

Nationally, the unemployment rate was 5.4 per cent in August, up from a historic low of 4.9 in June and July.

It was the first time in seven months the national jobless rate had risen.

Statistics Canada says the economy lost 31,000 jobs in August, marking the second consecutive month of job losses.

CTVNews.ca Top Stories

Pedestrian, baby injured after stroller struck and dragged by vehicle in Squamish, B.C.

Police say a baby and a pedestrian suffered non-life-threatening injuries after a vehicle struck a baby stroller and dragged it for two blocks before stopping in Squamish, B.C.

Senate expenses climbed to $7.2 million in 2023, up nearly 30%

Senators in Canada claimed $7.2 million in expenses in 2023, a nearly 30 per cent increase over the previous year.

Demonstrators kicked out of Ontario legislature for disruption after failed keffiyeh vote

A group of demonstrators were kicked out of the legislature after a second NDP motion calling for unanimous consent to reverse a ban on the keffiyeh failed to pass.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

RCMP uncovers alleged plot by 2 Montreal men to illegally sell drones, equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Government agrees to US$138.7M settlement over FBI's botching of Larry Nassar assault allegations

The U.S. Justice Department announced a US$138.7 million settlement Tuesday with more than 100 people who accused the FBI of grossly mishandling allegations of sexual assault against Larry Nassar in 2015 and 2016, a critical time gap that allowed the sports doctor to continue to prey on victims before his arrest.

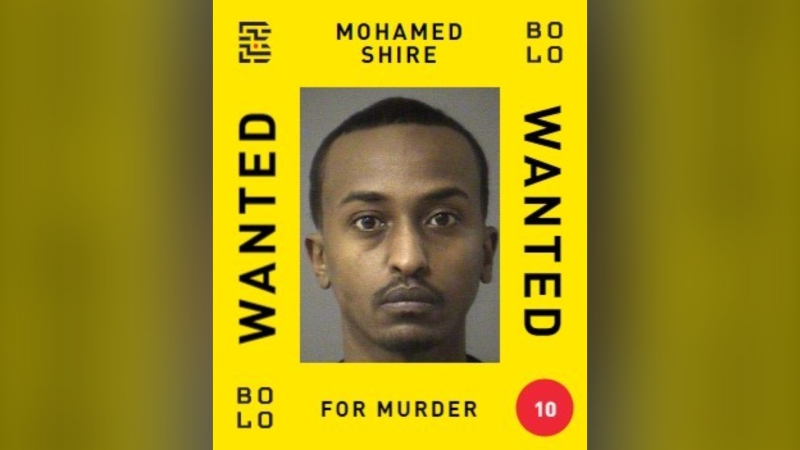

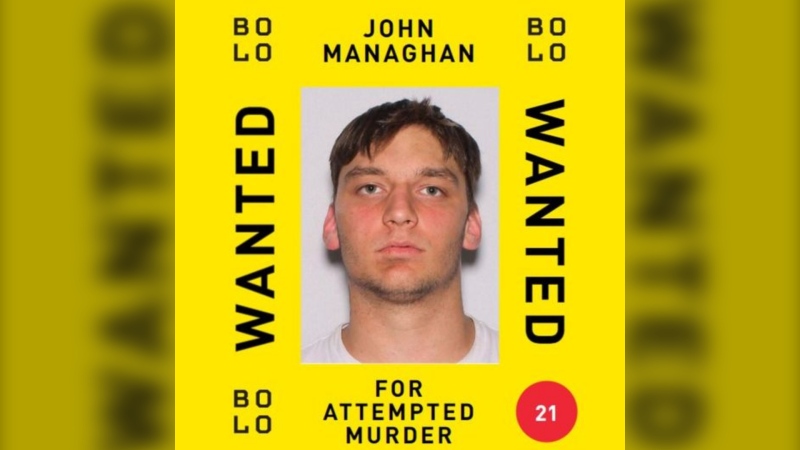

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.

Pro-Palestinian protests roiling U.S. colleges escalate with arrests, new encampments and closures

The student protests of Israel's war with Hamas that have been creating friction at U.S. universities escalated Tuesday as new encampments sprouted and some colleges encouraged students to stay home and learn online, after dozens of arrests across the country.