Calgarians concerned about retirement plans amid high inflation, rising costs

A new survey from the Bank of Montreal is shedding light on Canadians’ concerns about the economy and the impact it will have on retirement plans.

Chelsea Renaud is just starting a family, but says retirement savings are on her mind.

“You need to plan for the future, send the kids to school, college, everything like that. So, definitely a bit of a concern,” she told CTV News.

The Calgary mom and teacher isn’t the only one.

According to the BMO survey, Canadians now believe they need $1.7 million in savings, including things like the Canada Pension Plan, in order to retire.

That’s a 20 per cent increase from 2020, when respondents expected to need $1.4 million.

“It’s a reflection of how Canadians are feeling. We’ve just gone through a pandemic and now it’s combined with that and going through an environment where we have high interest rates and rising prices,” said Caroline Dabu, BMO’s head of wealth distribution and advisory services.

“That is leading Canadians to feel they have less confidence around saving and investing towards their retirement goals and certainly feeling that they’re going to need more.”

Canada’s annual inflation rate hit a high of 8.1 per cent in June 2022 and has since fallen to 6.3 per cent as of December 2022.

Across all age groups, 74 per cent of respondents said they are concerned about the current economic situation.

Fifty-nine per cent said conditions like high inflation have affected their confidence in meeting their retirement goals.

Some Calgarians, like Sandra Wigg, agree.

“Do I have enough? And at my age, you know, is there a possibility to make sure that I can retire the way I want to?” she said.

Others aren’t too concerned.

“I grew up when inflation was at 12 or 15 per cent and, you know, people seemed to survive at that time,” Bliss Aime said.

“I’m not saying that inflation is not an issue, but I think at some point, our lifestyle has to change in relation to what we spend money on.”

Just 44 per cent of Canadians surveyed are confident they will have enough money to retire.

Under a quarter (22 per cent) plan to retire between the ages of 60 and 69, with an average age of 62.

Faisal Karmali, senior wealth advisor and portfolio manager with the Popowich Karmali Advisory Group, says retirement planning all comes down to the individual.

“Looks at your current situation, where you want to be when you retire and how you’re going to get there. And that number, whatever it may be, $1.7 million or anything much lower or much higher, all depends upon you as the individual,” he said.

Karmali recommends people meet with a financial advisor to come up with a written plan that takes into account their lifestyle and retirement goals so they can save accordingly.

He also reminds people that retirement has many phases, so it’s important to save for the fun years, the slow years and potential long-term care needs.

Renaud is hopeful the current economic conditions will turn around.

“Hopefully, wages and everything else will go up and we’ll be able to keep on track,” she said.

The BMO survey was conducted between Nov. 4 and 7, 2022, by Pollara Strategic Insights via an online survey of 1,500.

The survey's margin of error is plus/minus 2.5 per cent, 19 times out of 20.

CTVNews.ca Top Stories

Senate expenses climbed to $7.2 million in 2023, up nearly 30%

Senators in Canada claimed $7.2 million in expenses in 2023, a nearly 30 per cent increase over the previous year.

Pedestrian, baby injured after stroller struck and dragged by vehicle in Squamish, B.C.

Police say a baby and a pedestrian suffered non-life-threatening injuries after a vehicle struck a baby stroller and dragged it for two blocks before stopping in Squamish, B.C.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

'It's discriminatory': Individuals refused entry to Ontario legislature for wearing keffiyeh

Individuals being barred from entering Ontario’s legislature while wearing a keffiyeh say the garment is part of their cultural identity— and the only ones making it political are the politicians banning it.

RCMP uncovers alleged plot by 2 Montreal men to illegally sell drones, equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Government agrees to US$138.7M settlement over FBI's botching of Larry Nassar assault allegations

The U.S. Justice Department announced a US$138.7 million settlement Tuesday with more than 100 people who accused the FBI of grossly mishandling allegations of sexual assault against Larry Nassar in 2015 and 2016, a critical time gap that allowed the sports doctor to continue to prey on victims before his arrest.

Canucks goalie Thatcher Demko won't play in Game 2

The Vancouver Canucks will be without all-star goalie Thatcher Demko when they face the Nashville Predators in Game 2 of their first-round playoff series.

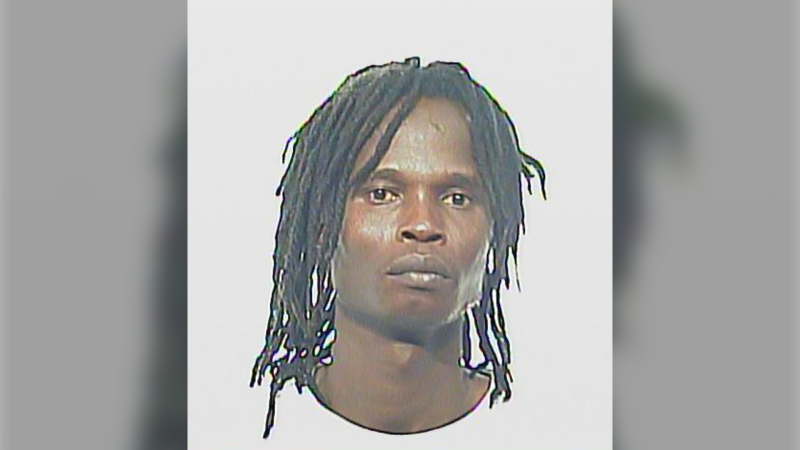

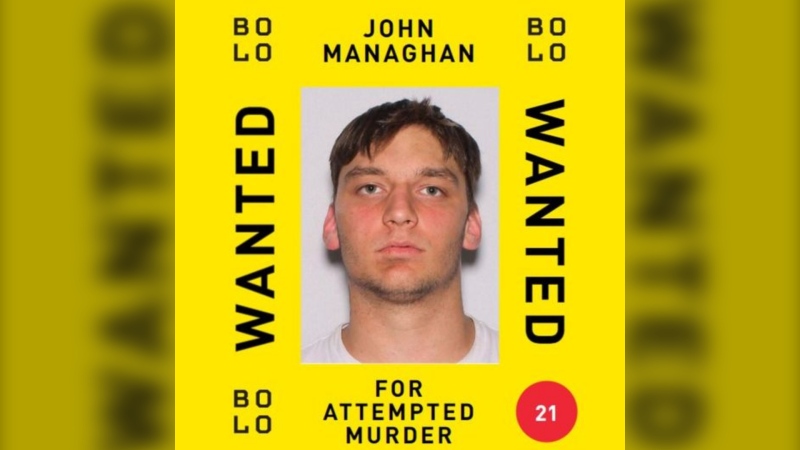

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.