Calgarians experience sticker shock at the pumps as oil and gas prices hit multi-year highs

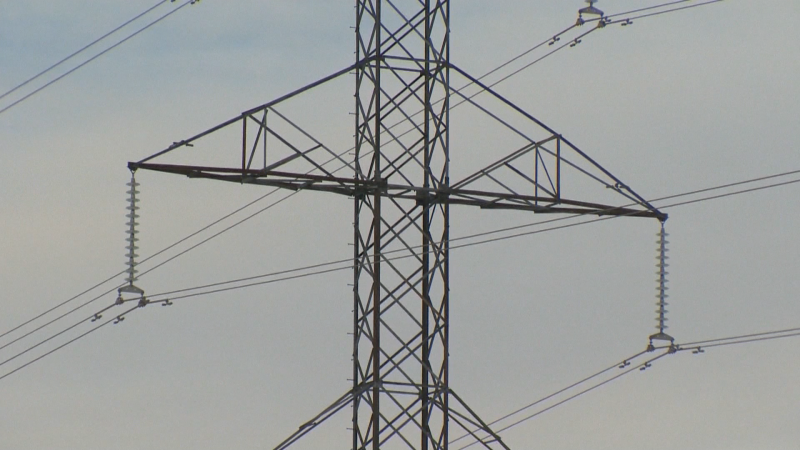

A hefty 12 cent increase in gas prices is creating sticker shock for Calgarians as oil prices reach a seven-year high – and analysts warn consumers should prepare to up their spending.

Benchmark U.S. natural gas prices hit a 12-year high this week, while oil continues to surge towards US$80 a barrel, reaching its highest point since 2014.

In fact, crude oil prices are up nearly 63 per cent in 2021, while natural gas is 2.5 times higher, but this means the cost for a litre of regular unleaded gasoline in Calgary was hovering at around the $1.43 mark as of Wednesday morning.

"These are near, if not past, all time record prices. This is really in response to oil increasing from $US71 to $US79 per barrel in the span of a couple of days," said Dan McTeague, president of Canadians for Affordable Energy.

"Short term, next week we could see the price drop a penny or two as early as Friday on the wholesale price, so this has nothing to do with the Canadian Thanksgiving. Remember, all oil prices and energy prices are based in the United States and they don’t have a long weekend coming up."

The increase comes after OPEC+ members met Monday and agreed not to increase output beyond previously announced increases of 400,000 barrels of oil per day for November, in an effort to restore the output slashed during the pandemic.

"There's a lot of commentary that says we could even get back to that $100 per barrel level," said Raymond James analyst Jeremy McCrea, who adds that natural gas, propane, coal and oil all hit multi-year highs this week as a result of a global energy shortage.

"Just given the constraint that a lot of these companies have been facing in the boom-bust cycle that we've experienced over the last 20 years, no one is rushing in to this current supply these current prices, and as a result these prices just keep inching higher and higher and higher."

McCrea adds that it is "quite surprising" that prices are this high, even before the peak winter demand, which will inevitably result in a higher cost for consumers at the gas pumps.

Rising energy prices have now added more fuel to the fire as consumers struggle to recover financial ands continue to deal with an inflated cost of living across the board.

CIO with Auspice Capital, Tim Pickering, says the oil and gas industry has been plagued by about a decade of underinvestment, not only in the actual infrastructure of commodities, but also by enormous pressure both politically and environmentally.

"From a price perspective, it's been really tough to invest in the space and that's all caught up to the industry," Pickering said.

"When you undersupply an industry, eventually, you get a whip back – and that that's what we're experiencing."

The OPEC+ cap on 400,000 barrels per day came with an initial reaction from the marketplace that oil prices would be pushed down, but according to Pickering, this sent the message instead that demand was coming back as pandemic restrictions ease.

He says many factors have changed as result of the massive amount of stimulus spending by global central banks in an effort to rejuvenate the economy and 'build back better.'

"There is no build back better without commodities and energies or principle to that, and so when you look at that whole scenario that is unfolded in 2021, we come to a much more bullish outlook for commodities and for energies than we came into 2021 with," Pickering said.

"We're not even fully opened up as a world as we know from COVID, and yet we see a significant draw on supplies, there's a lot of demand."

The price at the pumps is expected to jump by another cent or two across the country over the coming days, hitting historic highs just in time for the Thanksgiving weekend, thanks to increased demand and undersupply of oil globally.

NATURAL GAS PRICES HIT MULTI-YEAR SEASONAL HIGHS

Heavily discounted natural gas prices in Alberta have now frustrated domestic producers, who worry they could miss out on the upside of a global rally ahead of the winter months.

Natural gas prices have hit multi-year seasonal highs across North America as a result of low storage levels and increased demand overseas.

A looming energy crisis in Europe where natural gas prices are spiking due to shortages, along with increased demand for liquefied natural gas in Asia is creating a stronger outlook for petroleum producers.

However, this means consumers will be forced to pay higher prices this winter to heat their homes and fuel their vehicles.

"Natural gas has been quite cheap the last few years and so producers haven't put a lot of money into expanding production so that's kept a lid on supply at the same time as the economy has been reopening and recovering around the world," said ATB Financial Chief Deputy Economist, Rob Roach.

"It’s picking up now over the last few months and that is rising demand as well as other factors that are longer term, but you know put those two things together and that’s pushing the price up."

Roach adds that natural gas prices are double and, in some cases, almost triple the amount they were just a couple of years ago.

"This is definitely a much higher price environment and we're going to feel it when we get those bills absolutely."

ALBERTA RESOURCE REVENUES EXPECTED TO INCREASE

According to Alberta’s latest fiscal update released in August, the province forecasted the price of West Texas Intermediate (WTI) oil to average at around $US65.50 per barrel, which was $19 higher than in the original budget.

As a result, the province’s resources revenues are expected to be $9.8 billion, which is an increase of $6.9 billion.

However, now that the price of WTI has jumped up closer to the $US$77 range as of Wednesday, some analysts like McTeague forecast an extra $2 billion in revenue.

Meanwhile, McCrea says revenues could reach the $11 to $14 billion mark, especially if gas prices hold in as well and the differential remains low.

Meanwhile, Pickering says each dollar change in the price of a barrel of oil this year is worth about $230 million to the Alberta government’s bottom line.

He says resource revenue for oil could climb as high as $14.6 billion in incremental revenue.

CTVNews.ca Top Stories

NEW After hearing thousands of last words, this hospital chaplain has advice for the living

Hospital chaplain J.S. Park opens up about death, grief and hearing thousands of last words, and shares his advice for the living.

Some Canadian families will receive up to $620 per child today

More money will land in the pockets of some Canadian families on Friday for the latest Canada Child Benefit installment.

BREAKING Iran fires at apparent Israeli attack drones near Isfahan air base and nuclear site

An apparent Israeli drone attack on Iran saw troops fire air defences at a major air base and a nuclear site early Friday morning near the central city of Isfahan, an assault coming in retaliation for Tehran's unprecedented drone-and-missile assault on the country.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Ottawa to force banks to call carbon rebate a carbon rebate in direct deposits

Canadian banks that refuse to identify the carbon rebate by name when doing direct deposits are forcing the government to change the law to make them do it, says Environment Minister Steven Guilbeault.

Ontario woman loses $15,000 to fake Walmart job scam

A woman who recently moved to Canada from India was searching for a job when she got caught in an online job scam and lost $15,000.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.