In what feels like an annual rite of spring, the cost of filling a vehicle has made a dramatic jump in the days prior to the first long weekend of the season.

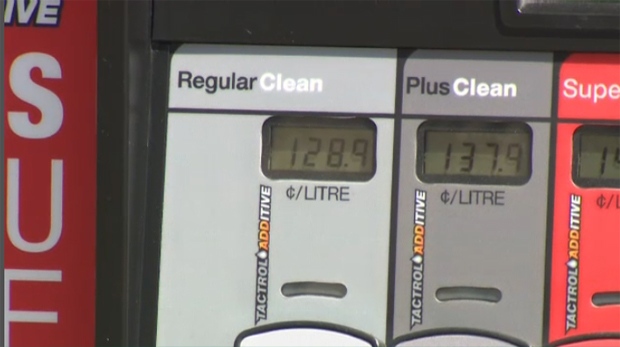

According to GasBuddy.com, as of 11:30 a.m. Thursday morning, the average price of a litre of gas is just over $1.25 with the highest recorded price being $1.289 at a full-service Petro-Canada station in Mission.

The current cost is an increase of nearly 10 cents more per litre than Tuesday's posted prices.

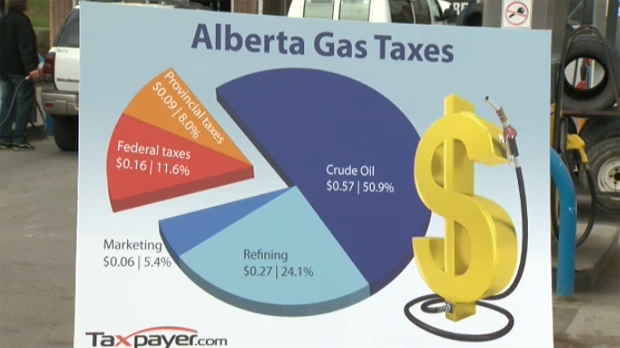

According to the Canadian Taxpayers Federation, the government is the recipient of a significant portion of the funds collected at the pump and many taxpayers are unaware of the breakdown.

In a Thursday morning announcement, the Canadian Taxpayers Federation (CTF) revealed the following statistics:

- Albertans pay an average of $15.55 in taxes every time they fill up

- $80 million in tax-on-tax is collected from Albertans every year

- The typical two car family pays $787 each year in gas tax

"In Canada this year, the federal and provincial government will collect ten of billions of dollars in gas and diesel taxes,” says the CTF’s Derek Fildebrandt. “On top of that, they'll levy sales taxes. Those sales taxes are levied not just on the base pump price, but on the crude oil, on the marketing, on the actual real cost of pretax oil, but on top of the government’s own hidden buried taxes. In Canada, that works out to $1.6 billion on hidden tax-on-tax."

The federal taxes are penciled to go towards infrastructure but the CTF says it isn’t properly controlled and many municipalities could be spending the money on other things.

The CTF have outlined a gas tax accountability act where it makes it mandatory to use ever dollar spent on infrastructure and hopes the government will adopt the act.

For more information, visit the 2013 CTF Gas Tax Honesty Report.