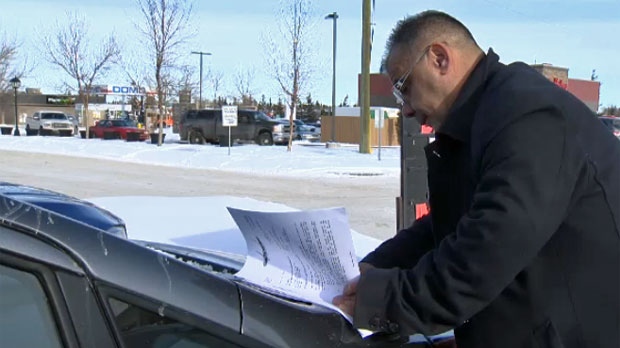

A misplaced certified cheque has left a local real estate investor out hundreds of thousands of dollars and he says the bank will not allow him to access his funds.

Peter Hasna says he visited the Scotiabank on Falconridge Boulevard Northeast on August 11, 2017.

“I sold one of the properties and the lawyer gave me a cheque,” said Hasna. “That same day I came to the branch behind us now, the Bank of Nova Scotia, and went and certified it.”

Hasna says branch employees granted his request for a photocopy of the certified cheque in the amount of $415,000 for his records and he left the bank. After a short business meeting at a local coffee shop, Hasna said he drove to his home branch to deposit the certified cheque so he could pay his investors but he couldn’t find the cheque.

“I called the Bank of Nova Scotia to see if it’s in the photocopier and they said no, so I rushed back (to the branch),” said Hasna. “The bank manager said to me, very, very simple, to sign a bond of indemnification stating the fact that since I lost that cheque, if that cheque ever comes back I’m still liable. So I signed it right away.”

Hasna says the bank manager told him the bond would need to be notarized so he complied and visited a lawyer he knew who has an office in the area. “The gentleman that gave me the cheque, he witnessed it, and I came back to the bank and they asked for an insurance bond to protect the bank for the whole $415,000 cheque.”

The real estate investor says he contacted several insurance companies but no one would issue a bond. “Different insurance companies confirmed nobody would give a bond on that type of a cheque because of the fact I’m not the issuant of the cheque.”

“I came back to the bank and the bank wants a 10 year hold on (the funds), a 10 year hold if they don’t have surety.”

Hasna says he was directed to the office of the president of Scotiabank and Scotiabank’s ombudsman and both indicated the requirements were at the discretion of the branch manager.

“For the last six months in that bank they’re making interest on that money,” said Hasna. ““They’re waiting for somebody with my name to cash that specific cheque but I’m that person and I don’t have that cheque.”

Hasna says, on top of the $415,000 in frozen funds, he’s out tens of thousands of dollars in legal fees and interest.

Scotiabank officials released the following statement to CTV Calgary regarding Hasna’s situation.

“We very much regret the position that this individual explains he is in. Unfortunately, we are unable to provide specific comment on this situation as the matter is now before the courts.

For your background information, a draft or certified cheque is the same as cash, and in order to have it replaced, the individual must have the means to insure the Bank should the original draft be cashed. Certified cheques cannot be stopped and do not expire, as such, the Bank would be liable for the cheque should the original be presented for payment. Replacing a lost, stolen, or destroyed certified cheque on the strength of a Surety Bond is standard practice, and protects the Bank from the potential liability of the cheque being presented for payment. Given that certified cheques do not expire, and are as good as cash, they cannot simply be replaced or stopped the way a normal cheque would be handled.”

Hasna says he is scheduled to appear in court next week in an attempt to gain access to his funds but he hopes the matter will be settled prior to that. “I just want my money back.”

With files from CTV’s Bill Macfarlane