CALGARY -- Efforts to stay home during the pandemic has shaken up how Calgary households spend and how they save.

Some families are looking at adding to their savings or chipping away at debt now that discretionary spending has dropped.

Tara Crape says her weekly spending on groceries is down by roughly $100 a week by ordering only what she needs to her doorstep and avoiding shopping in-store.

"I’m resisting that temptation of walking down an aisle and going, 'Oh I need that or 'Oh I need this.'"

She and her two sons nine-year-old Joshua and five-year-old Matti are home from school, sports and family camping trips.

"That’s hundreds of dollars that we’re saving just in a couple of weeks," said Crape.

While her youngest says he is "super bummed" about not being able to enjoy a regular spring and summer, Crape says this moment could be an opportunity to address the family’s finances.

"Any money we do get we’re trying to pay that debt down and become in a better position should things continue to get worse."

Spending trends downward

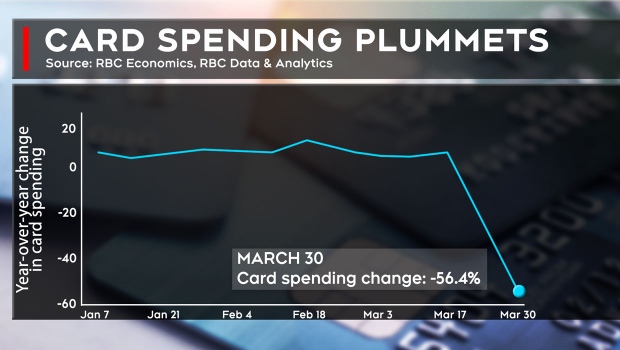

According to RBC, Canadians were spending nearly 60 per cent less with the debit and credit cards during the last week of March, compared with the same time a year earlier.

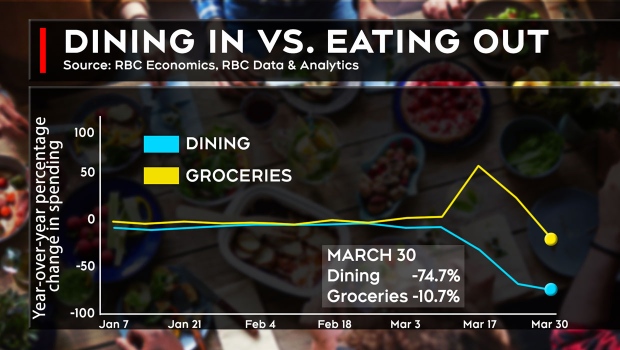

The bank also reports a brief spike in grocery spending at the beginning of the outbreak, but that’s began to slowly decrease to 10 per cent below levels the previous year.

Dining out has dropped off dramatically, at nearly 75 per cent from March 2019.

Some financial experts say changes in discretionary spending could create more room for saving and investments if done wisely.

"I would caution people to throwing tens or thousands of dollars (into the market, investments or savings accounts) at once. It’s probably a better idea to spread that out over weeks or months," said Janine Rogan, chartered professional accountant and founder of the Wealth Building Academy.

"We obviously don’t want you to be in a situation where you are contributing to your retirement, which is awesome, but you can’t pay your utilities."

Other financial advisors say it’s important to be reminded that many Calgarians financial struggles have been exacerbated by COVID-19.

"We knew before the pandemic that half of Canadians were reportedly living paycheck-to-paycheck and one third didn’t have enough savings to be able to get through for three months and stay above the poverty line," said Jeff Loomis, executive director of Momentum.

The organization provides programming to help those on low incomes improve their financial literacy and plan for emergencies.

Loomis advises setting aside funds in case of emergencies is critical at any time, but has noted an increase in the number of clients "cashing out" their emergency savings from Momentum, just to help cover costs.