CALGARY -- Municipal and provincial politicians are pointing the finger at each other over the latest numbers that show Calgary property owners will pay more in taxes this year.

A presentation prepared by city administration shows the combined impacts of the Alberta government's 2019 and 2020 budgets have resulted in an 11.3 per cent increase in provincial education property taxes.

"It's crazy. This is not what we were promised," said Coun. Jeff Davison. He says the city was working under that assumption that the provincial education property tax requisition would be maintained at the same rate as last year, but the newest Alberta budget calls for the rates to increase.

"I don't think we underestimated it at all," Davison added. "I think we were moving forward on a number of assumptions that the province has given us and, to be frank, it feels like somebody pulled the carpet from under our feet."

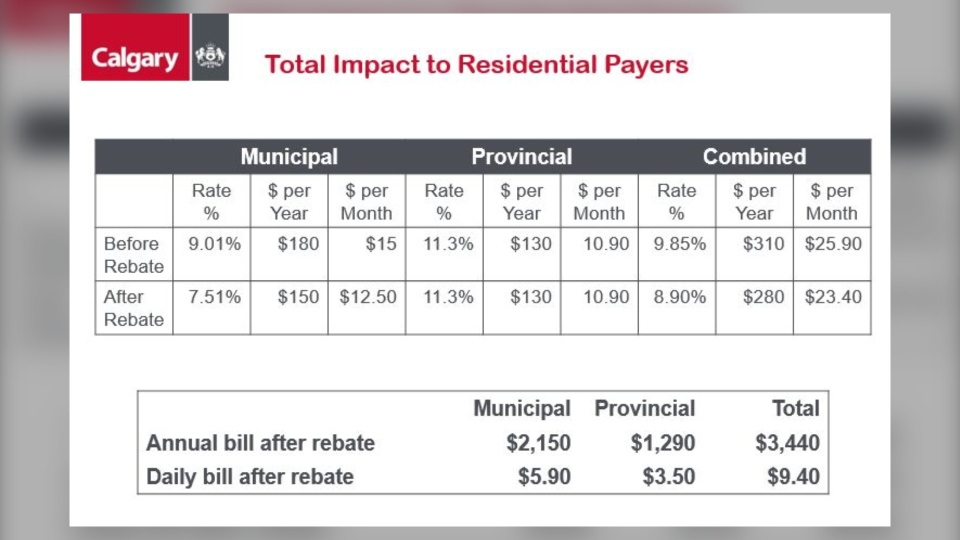

When combining the impacts of the City of Calgary’s already approved 7.5 per cent tax hike, the total tax increase is now 8.9 per cent for 2020.

It's estimated the average Calgary homeowner — with a home assessed at $455,000 — will pay an additional $280 in property tax in 2020.

The average annual property tax bill in 2020 will be $3,440, with $2,150 going to the city and $1,290 going to the province.

Here’s a look at the expected increases for an average Calgary home (Courtesy: City of Calgary)

Alberta municipal affairs minister Kaycee Madu tweeted out a response to council's concerns.

"Last year, the City of Calgary under-estimated its projection for the 2019 education property tax requisition," the tweet read in part. A request for further comment from Madu has so far been unanswered by the ministry.

Taxpayer groups say both parties are to blame.

"Both the city and our provincial politicians need to look in the mirror and they need to realize that taxpayers have been struggling through a tough downturn for years," said Franco Terrazzano of the Canadian Taxpayers Federation.

Several city councillors made it known at Monday’s council meeting that they now want further clarification on property tax bills. Council has now asked city administration to come up with ways of getting information on tax bills to show how money stays in the city and goes to the province.

There is a bright spot in this latest provincial budget for non-residential ratepayers (small businesses) who will see a 12.2 per cent drop in their provincial property taxes.

The full impact of the tax shift won’t be known until property tax bills are mailed out this spring.

City impacts

One of the biggest areas of concern has been the province's decision to cut $53 million from the budget for the maintenance of affordable housing in Calgary over the next three years.

Council heard Monday that those reductions could result in the closure of 100 affordable housing units at a time when the city is in need of an additional 15,000 units.

Another report received by council showed a $4 million reduction in fine revenues for the Calgary Police Service. The provincial budget last fall resulted in the provincial government withholding $13 million reduction in fine revenues.

Council has filled in that CPS funding gap in the fall but it’s not yet known how the city will handle this latest reduction.