Enbridge to purchase U.S. renewable gas facilities for US$1.2 billion

This June 29, 2018 photo shows tanks at the Enbridge Energy terminal in Superior, Wis. THE CANADIAN PRESS/AP-Jim Mone

This June 29, 2018 photo shows tanks at the Enbridge Energy terminal in Superior, Wis. THE CANADIAN PRESS/AP-Jim Mone

Canadian pipeline giant Enbridge Inc. has signed a deal to purchase seven existing renewable natural gas facilities in Texas and Arkansas for US$1.2 billion.

The acquisition of the facilities from Texas-based Morrow Renewables establishes Enbridge as one of the largest transporters of renewable natural gas by volume in North America, the Calgary-based company said Friday.

Renewable natural gas, often called RNG, refers to non-fossil-fuel-based renewable energy created from organic waste.

The seven facilities currently deliver RNG from municipal landfills in six Texas locations as well as Fort Smith, Ark.

While RNG can be produced from many different sources, including agricultural waste and food waste, landfill RNG facilities collect the gas that is produced by waste decomposition in the landfill.

The gas is then treated and compressed into pipeline-grade methane, so it can be easily blended into existing natural gas transmission networks and used to fuel transit fleets and heat homes and businesses.

“RNG fundamentals are strong in the United States and indicate continued growth in demand over the long-term as gas utilities increasingly continue to set RNG blending targets,” said Enbridge CEO Greg Ebel on a third-quarter conference call Friday.

“This was the perfect opportunity to meaningfully add to our RNG portfolio with an accretive ... tuck-in.”

Ebel said 60 per cent of the cash consideration for the purchases will be spread over a two-year period.

According to the World Biogas Association, organic waste from food production, food waste, farming, landfill and wastewater treatment are responsible for about 25 per cent of human-caused global emissions of methane, a harmful greenhouse gas.

But it's possible to harness the methane from organic waste to create an environmentally friendly alternative to traditional natural gas that can be used for home heating, cooking, and even fuelling vehicles.

Enbridge is one of a number of traditional fossil fuel companies that have been investing in RNG as concerns about climate change intensify.

Prior to Friday's announcement, Enbridge Gas was actively involved in seven Canadian RNG projects operating or under construction, with more than 50 proposed projects in various stages of development.

In March, Enbridge purchased a 10 per cent stake in Divert Inc., a U.S.-based food waste management company. Together, the two companies plan to partner on several projects across the U.S. that will convert food waste into renewable energy.

Also on Friday, Enbridge announced it has signed a deal to purchase from CPP Investments its stake in two offshore wind farms in Germany, for 625 million euros.

The company also remains on track to close by the end of the year its previously announced purchase of three U.S.-based utility companies - the East Ohio Gas Company, Questar Gas Company and its related Wexpro companies, and the Public Service Company of North Carolina.

The US$14 billion cash-and-debt deal is currently going through the regulatory approvals process south of the border. Enbridge said Friday it has secured 75 per cent of the financing required to complete the transaction.

Enbridge delivered a profit of $500 million in the third quarter of 2023, compared with $1.3 billion a year earlier.

The company said Friday its profit amounted to 26 cents per share for the quarter ended Sept. 30 compared with 63 cents per share in the same quarter a year earlier.

On an adjusted basis, Enbridge said it earned 62 cents per share, down from an adjusted profit of 67 cents per share a year earlier.

This report by The Canadian Press was first published Nov. 3, 2023.

CTVNews.ca Top Stories

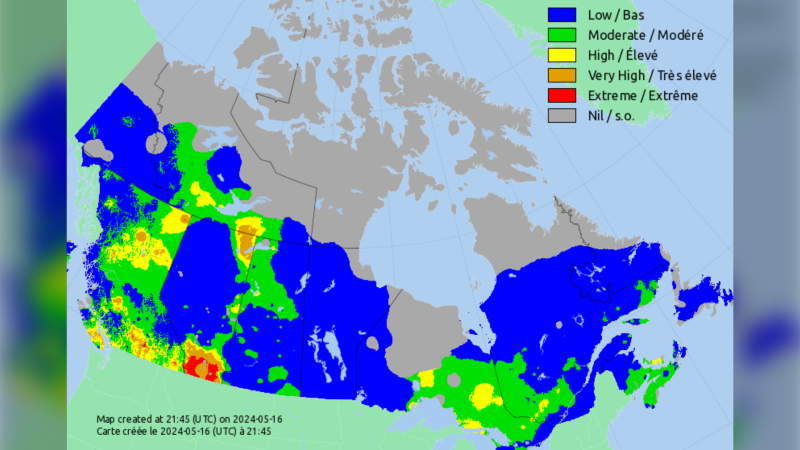

DEVELOPING 122 active wildfires burning across Canada, 32 considered 'out of control'

The 2024 wildfire season has begun, and it's shaping up to follow last year's unprecedented destruction in kind, with thousands of square kilometres already consumed.

B.C. parents sentenced to 15 years for death of 6-year-old boy

A British Columbia Supreme Court judge has sentenced the mother and stepfather of a six-year-old boy who died from blunt-force trauma in 2018 to 15 years in prison.

Veteran TSN sportscaster Darren Dutchyshen has died

Veteran TSN broadcaster Darren 'Dutch' Dutchyshen, one of Canada’s best-known sports journalists, has died. He was 57. His family says 'he passed as he was surrounded by his closest loved ones.'

Miller scores late as Canucks grind out 3-2 win over Oilers in Game 5

J.T. Miller scored in the final minute of the game and the Vancouver Canucks came back for a 3-2 victory over the Edmonton Oilers in Game 5 of their second-round playoff series Thursday.

Think twice before sharing 'heartbreaking' social media posts, RCMP warn

Mounties in B.C. are urging people to think twice before sharing "heartbreaking posts" on social media.

Police issue Canada-wide warrant for Regina homicide suspect

Police have issued a Canada-wide warrant for a man wanted in a homicide which occurred in Regina on May 12.

Trudeau calls New Brunswick's Conservative government a 'disgrace' on women's rights

Prime Minister Justin Trudeau assailed New Brunswick's premier and other conservative leaders on Thursday, calling out the provincial government's position on abortion, LGBTQ youth and climate change.

Kevin Spacey receives star support as he fights to get his career back

Kevin Spacey is pushing back on the 'rush to judgment' against him and is being backed by some big names as he seeks to reclaim his acting career.

Speaker cuts ties with Sask. Party, alleges he faced threats, harassment from gov't MLAs

The Speaker of the Saskatchewan Legislature Randy Weekes has severed ties with the Sask. Party after accusing some members of harassment and intimidation tactics, including a situation he claimed saw the Government House Leader bring a hunting rifle to the legislative building.