Here's how Canada's capital gains tax increase will affect Albertans with vacation properties

Albertans selling vacation properties after June 25, 2024, will have to pay more in taxes due to increased capital gains taxes. (Source: Trilliant Real Estate Group)

Albertans selling vacation properties after June 25, 2024, will have to pay more in taxes due to increased capital gains taxes. (Source: Trilliant Real Estate Group)

A new capital gains tax increase, aimed at Canada’s highest earners, is causing frustration for some Albertans with secondary homes or cottages, according to a real estate broker.

Starting on June 25, the tax will increase from 50 per cent to 67 per cent.

“It’s going to have an impact without a doubt,” said Jim Jardine, an associate broker with Trilliant Real Estate Group.

Jardine specializes in selling recreation property and has already spoken with at least a dozen people who are trying to figure out if they should sell their second property or hold on to it.

The government said the change will affect the wealthiest 0.13 per cent – about 12 per cent of Canada's corporations – and Canadians with an average income of $1.42 million.

“We don't have time to get it on the market and sold by the deadline that we've been given,” Jardine said.

- Sign up for breaking news alerts from CTV News, right at your fingertips

- The information you need to know, sent directly to you: Download the CTV News App

In Invermere, CTV News spoke with a couple of realtors who have had vacation homeowners reach out regarding the tax increase.

Gerry Taft, from Mountain Town Properties, said some of the people he has spoken to seem to be “maybe a bit in denial” about the increase coming on June 25.

“Some people that I think are unsure of whether or not this will actually come to be, but so far there hasn't been much reaction, we haven't seen rush of new listings,” said Taft.

For what could hit the market, Taft points to the possibility of “speculative” properties and condos.

“People have kind of bought them as investments, people are also keeping an eye on interest rates and market values,” said Taft.

For owners in both Sylvan Lake and Invermere, Jardine and Taft agree many homeowners will likely look at land transfers within the family instead of putting the properties on the market.

“Locally with some of the legacy properties, the lakefront properties, the really special cabins that have been in families for a long time, we've actually been seeing a lot of those transfer within the family,” said Taft.

How much is the tax?

Here is an example of how the tax increase will impact those selling a vacation home:

If a vacation home is purchased for $250,000 and later sold for $750,000, under current tax rules that would be a capital gain, or profit, of $500,000.

At 50 per cent, the taxable capital gain would be $250,000.

However, on and after June 25, the taxable gain on that same cottage would rise from $250,000 to $291,750.

How much you would actually pay on these gains would depend on your marginal tax rate.

“May (is when) we get into the prime recreational selling time and I can tell you right now, I don't have much for sale,” said Jardine. “There's a lot of frustration as to what the implications are.”

Evelyn Jacks, the president of the Knowledge Bureau and author of 55 tax books, recommends people don’t rush into making a decision and speak with a tax specialist.

“This is a huge tax increase, and it’s going to impact a lot of people,” she said.

“I think what's really important is that people get good sound advice and look at the numbers the numbers are going to tell the story.”

CTVNews.ca Top Stories

BREAKING Loblaw agrees to sign grocery code of conduct after months of negotiations

Loblaw Cos. Ltd. said Thursday it's ready to sign on to the grocery code of conduct, paving the way for an agreement that's been years in the making.

Veteran TSN sportscaster Darren Dutchyshen has died

Veteran TSN broadcaster Darren 'Dutch' Dutchyshen, one of Canada’s best-known sports journalists, has died. He was 57. His family says 'he passed as he was surrounded by his closest loved ones.'

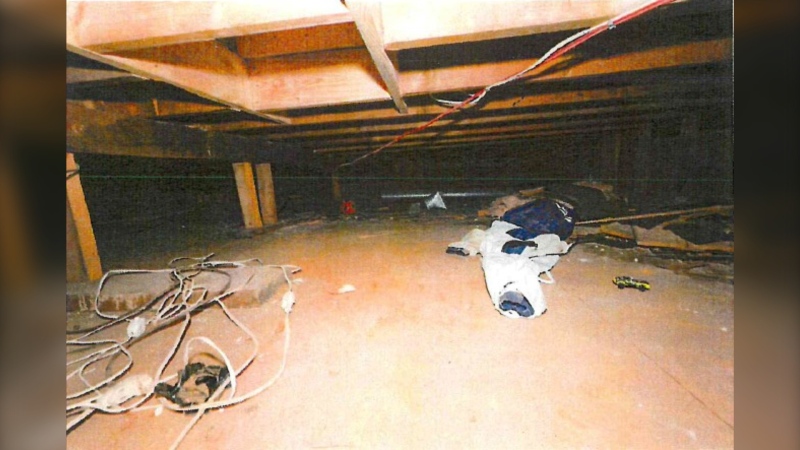

Kidnapped by her father and kept in a crawl space: Court documents reveal Montreal horror story

A Montreal father who kidnapped his daughter who has autism and lied to police when they asked where she was should serve three years in prison, a Crown prosecutor said.

Pierre Poilievre presses Justin Trudeau for summer pause on carbon and fuel taxes

To give Canadians a break on their summer road trips, Conservative Leader Pierre Poilievre is calling on Prime Minister Justin Trudeau to suspend all gas and diesel taxes from Victoria Day to Labour Day.

Teen died from eating a spicy chip as part of social media challenge, autopsy report concludes

A medical examiner says a Massachusetts teen who participated in a spicy tortilla chip challenge died from ingesting a substance 'with a high capsaicin concentration.'

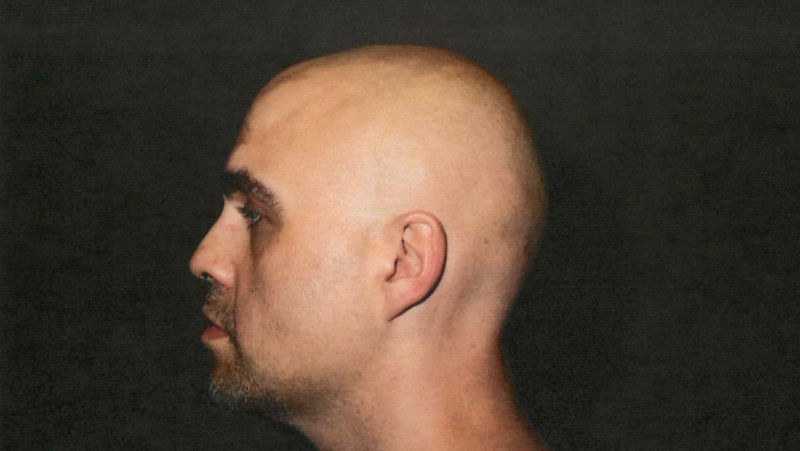

Ontario's so-called 'Crypto King' soliciting investments as recently as February: police

Police are alleging that Ontario’s so-called ‘Crypto King’ Aiden Pleterski was soliciting investments as recently as February – almost two years after he was petitioned into bankruptcy for allegedly running a Ponzi scheme worth more than $40 million.

Noticed a new payment? Some Canadians get first carbon rebate

Many Canadians found a message from the Canada Revenue Agency this week as they received their first direct deposit for the Canada Carbon Rebate.

Drones smuggled drugs across Niagara River into U.S., 3 suspects caught in New York

A smuggling operation used drones to fly drugs across the Niagara River from Canada into upstate New York, using a newly purchased US$630,000 house along the river as a drop point, according to a criminal complaint unsealed this week.

Protecting your car from the growing risk of keyless vehicle thefts

Auto technology has evolved and many newer cars use wireless key fobs and push-button starters instead of traditional metal keys. But that technology also makes things easier for thieves.