No 'April Fools' joke: Albertans to see carbon tax increase on April 1, higher rebates also expected

Calgarians can expect to pay more to fill up their car or heat their homes starting Saturday when the federal government’s carbon tax is set to increase national carbon prices.

This year, the carbon price for individuals and small businesses will increase by $15 per tonne of greenhouse gasses emitted to a total of $65 per tonne.

In Alberta, that translates to a carbon tax on gasoline of 14.3 cents per litre, up from 11 cents currently. It means that the cost of a 40-litre tank of gas will go up by about $1.30, while the average monthly natural gas bill will increase by $5.22.

A 20 Ib propane tank will also roughly cost another 77 cents extra to fill.

Along with the increases, Ottawa has also increased carbon price rebate cheques for the province.

The carbon price rebate in Alberta will increase by 43 per cent, the most out of any province, with cheques sent out quarterly. Single individuals will receive a total of $722 per year and a family of four can expect to get back $1,544 over the next 12 months.

MORE CARBON INTENSIVE

Kent Fellows, an assistant professor with the University of Calgary School of Public Policy, said provinces like Alberta will pay more in carbon tax because of its energy mix that is more carbon intensive.

“Alberta gets hit a little bit harder on this because it’s to do with the emissions intensity of our overall economy, which is kind of how the carbon tax is designed. I mean, it's supposed to encourage decarbonisation, and we have more work to do in Alberta than other provinces,” he said.

“The other side of it is the economic effect," he added. "So if you're working in a carbon intensive sector, and that sector has a reduction in output because of the carbon tax, it's the lost income, and that does potentially translate into lost jobs.”

Fellows noted that most of his data suggests that green jobs compensate for higher emissions when they are lost, but it still has an impact on Alberta households.

He said because Albertans earn more income on average, they are taxed progressively more through carbon pricing.

“It’s not only that higher income households are consuming more, they may actually be consuming higher emissions goods as well.”

“So you can think that if you've got a larger house and you've got to heat that for example, your expense towards heating is a carbon intensive expense if you're using something like natural gas.”

Federal carbon tax pricing changes will go into effect on April 1 for Alberta, Saskatchewan, Manitoba, Ontario, Yukon and Nunavut.

On July 1, the four Atlantic provinces will join the federal scheme because they previously had provincial systems that wouldn’t have met the new standards set by Ottawa going forward.

Quebec has its own cap-and-trade system, British Columbia uses an approved provincial carbon price and Northwest Territories has its own territorial carbon pricing policy.

CARBON TAX TO COST ALBERTA FAMILIES UP TO $710 ANNUALLY: PBO REPORT

A new report from the Parliamentary Budget Officer (PBO), a nonpartisan watchdog of federal spending, said the overall economic impact of the carbon price could drive down incomes and result in job losses in the long term.

Analysis from the PBO shows that the carbon tax will cost the average Alberta household $710 this year after the rebates.

Franco Terrazzano, the federal director of the Canadian Taxpayers Federation, pointed to this recent report as proof that Albertans will pay hundreds of dollars more than they’re bargaining for.

“This just shows that Prime Minister Trudeau is using ‘magic math’ to try to spin Canadians on his carbon tax,” he said.

“The PBO breaks down the numbers, it's very clear that the carbon tax will raise taxes, and skim some off the top. The $710 per year even after the rebates is a couple weeks of groceries for a family, but it’s just being taxed away.”

Terrazzano adds that the carbon tax will also increase the amount of sales tax Canadians pay.

“We estimate that $429 million in GST from the fuel charge will be collected in 2023-24, rising to $924 million in 2030-31, according to the PBO.”

When asked about the report, Fellows also noted that it looks at the fiscal cost of the carbon tax along with the fiscal plus economic cost.

“So if we just look at the sticker price and the rebate, the majority of households are still going to get a larger rebate than they’re going to pay in cost,” he said.

“But when we start factoring in those income effects, the economic effect, that’s when the math gets harder and the math doesn’t work out quite as nicely. Important to realize that this report is looking towards the 2030 date, not necessarily next year but it is the path that we’re on and I think it should raise some important questions for the federal government’s policies.”

CFIB QUESTIONS CARBON TAX REVENUE RETURNS FOR ALBERTA SMALL BUSINESSES

According to a new report from the Canadian Federation of Independent Business (CFIB), the federal government has returned less than one per cent of the $22 billion in federal carbon tax revenues to small businesses.

CFIB Alberta director Annie Dormuth said small businesses across the province are already struggling with increased costs and that the carbon tax is adding to that burden.

She noted that small businesses contribute significantly to the federal carbon tax, but don’t get the same amount back like individuals and households do through rebates.

“Small businesses are in a difficult position still recovering from the impacts of the pandemic, but now coupled with new economic challenges in the form of rising inflation, rising interest rates, and of course, government cost increases from really all levels of government,” Dormuth said.

Annie Dormuth

Annie Dormuth

“First of all, halt the increases that are going to be coming into effect on Saturday, as well as make the program more revenue neutral by returning to $2.5 billion back to small businesses.”

CFIB data shows that over half (52 per cent) of Canadian small firms oppose carbon pricing. If the price on carbon increases to $170 per tonne in 2030 – as per the federal government’s climate plan – over half (56 per cent) of small businesses said they will have to increase prices to offset costs.

Over four in ten (45 per cent) of small businesses said the increasing carbon tax will increase pressure on them to freeze or cut salaries and wages, while 40 per cent said they will have to reduce investment in their business.

ENERGY STRATEGIST SAYS CARBON PRICING HAS ENVIRONMENTAL BENEFITS

Greenpeace Canada energy strategist Keith Stewart said there are a number of benefits to Ottawa’s climate strategy that will see carbon tax pricing increase $15 per tonne per year, every year through to 2030.

“One of the obvious benefits is that as the carbon price goes up, so do the rebates and most Canadians actually get back more than they put in because of the way the price system works,” he said.

But the other thing is that carbon pricing is a core part of our climate strategy, it's not the whole thing, but think of it as a hockey team. Carbon pricing is the goalie. You need good goaltending to win the cup. You also need someone who's scoring goals, so you can't just count on the one thing, but if you don't have a goalie you're in trouble.”

When asked about the recent PBO report suggesting rebates will not be enough to cover the carbon tax cost, Stewart pointed to oil companies making large profits.

“Oil companies are making big bucks and that's shown in the price Canadians are paying at the pump, you don’t get that back,” he said.

“So, there's two things driving up price, one of them you get a refund on, the other not. But when you see the price just going up, I think we need to separate out those two things.”

ALBERTA FINANCE MINISTER RESPONDS

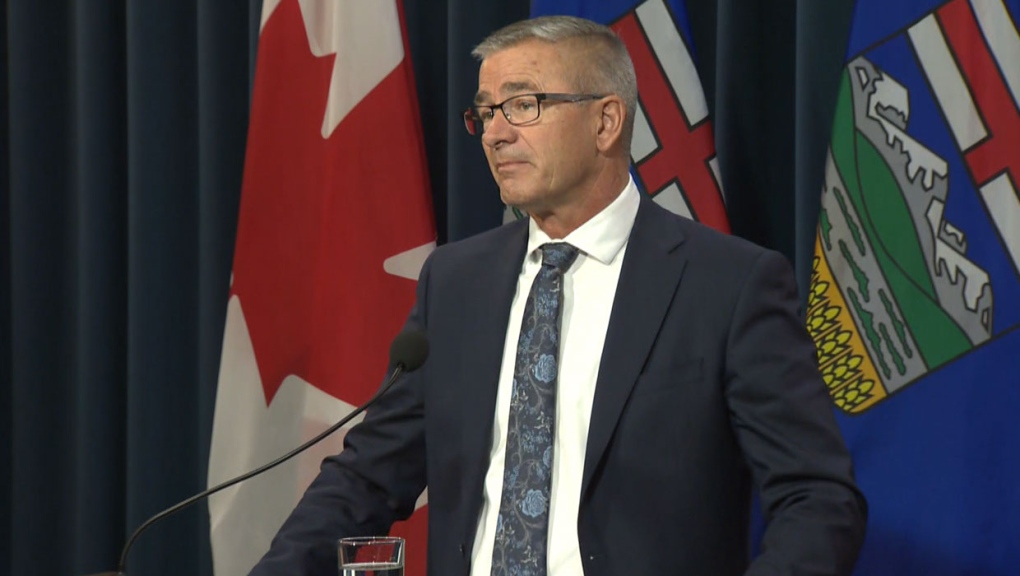

Saturday morning, Alberta finance minister Travis Toews issued a statement about the federal carbon tax increase.

"At a time of already high inflation, the increase of the federal carbon tax will make the cost of everything from home heating and electricity costs to grocery bills more expensive. It contrasts our province’s efforts to keep more money in the pockets of Albertans," Toews said.

Alberta's Finance Minister Travis Toews had details of the provincials fiscal update on Thursday, ahead of the first Smith government budget coming in the new year.

Alberta's Finance Minister Travis Toews had details of the provincials fiscal update on Thursday, ahead of the first Smith government budget coming in the new year.

"We urge the federal government to take the affordability crisis seriously and to immediately cancel the increase to the federal carbon tax, or better yet, eliminate the tax all together.

"Elimination of the carbon tax and pausing federal fuel taxes, would help millions of Canadians cope with rising costs."

With files from The Canadian Press

CTVNews.ca Top Stories

W5 Investigates 'I never took part in beheadings': Canadian ISIS sniper has warning about future of terror group

An admitted Canadian ISIS sniper held in one of northeast Syria’s highest-security prisons has issued a stark warning about the potential resurgence of the terror group.

'Absolutely been a success': Responders looks back at 988, Canada's Suicide Crisis Helpline, one year later

In its first year, responders for Canada's Suicide Crisis Helpline, known as 988, have answered more than 300,000 calls and texts in communities nationwide.

Prime Minister Trudeau meets Donald Trump at Mar-a-Lago

Prime Minister Justin Trudeau landed in West Palm Beach, Fla., on Friday evening to meet with U.S.-president elect Donald Trump at Mar-a-Lago, sources confirm to CTV News.

Nova Scotia PC win linked to overall Liberal unpopularity: political scientist

Nova Scotia Premier Tim Houston is celebrating his second consecutive majority mandate after winning the 2024 provincial election with 43 seats, up from 34. According to political science professor Jeff MacLeod, it's not difficult to figure out what has happened to Liberals, not just in Nova Scotia but in other parts of Canada.

'Mayday! Mayday! Mayday!': Details emerge in Boeing 737 incident at Montreal airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

Hit man offered $100,000 to kill Montreal crime reporter covering his trial

Political leaders and press freedom groups on Friday were left shell-shocked after Montreal news outlet La Presse revealed that a hit man had offered $100,000 to have one of its crime reporters assassinated.

Questrade lays off undisclosed number of employees

Questrade Financial Group Inc. says it has laid off an undisclosed number of employees to better fit its business strategy.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Billboard apologizes to Taylor Swift for video snafu

Billboard put together a video of some of Swift's achievements and used a clip from Kanye West's music video for the song 'Famous.'