Calgary agencies helping low-income and new Canadians file taxes

A Calgary non-profit is offering free tax clinics to its programs participants.

Momentum describes itself as a "change-making" organization that combines "social and economic strategies to reduce poverty."

Executive director Jeff Loomis says people living on lower incomes have two barriers to overcome when filing taxes.

"One is people are worried that they're going to owe money to the government, while most of the time people living on lower incomes actually receive benefits from filing taxes," he said.

"The second big barrier is oftentimes just a lack of knowledge or trust."

Loomis says Momentum will offer access to benefits support all year round so people can get benefits at a time that works well for them.

"We know that for Canadians living on lower income, filing taxes and then accessing the benefits can actually result in up to 50 per cent of their annual income," he said. "So it makes a huge difference for those people to be able to boost their incomes by filing taxes."

The clinics are made possible by a number of volunteers, like Dale Huntingford.

He says he'll likely see a few hundred people living this tax season.

"You spend 20 minutes with someone and you can get them access to some extra income," he said.

"Things like the GST rebates, the carbon tax rebates, the child tax benefit, often your access to subsidized housing programs and the low (cost) bus pass is related to showing your latest income tax filing."

Huntingford says he sees some people coming in who are afraid of forms or not comfortable with numbers and don't have access to a computer.

He says Canada Revenue is supportive of the volunteer filers and make it easy for them to access expert advice over the phone to help solve a client's problems quickly.

"One of the most satisfying (cases I've had is) a young mother raising her child and trying to keep going to school," he said. "Within 10 minutes (I got her) access to $10,000 of income, which kind of stabilizes them for another year, and that feels good."

Tyler Lindsey saw a volunteer to help file his taxes. He's currently unemployed, but worked a few jobs in 2023.

"They were able to go through it in about 10 to 15 minutes and get me quite a bit of money back," he said.

"Enough to keep me going for a couple of months here with all the pressure of everything being so expensive from inflation. It's really a life-saver for me."

The Immigrant Education Society (TIES) has hosted a free tax clinic supporting new Canadians since 2017.

Its volunteer-run clinic has seen more than double the clients, from an expected 300 taxpayers to over 800.

Noha El Tanahi, the acting manager of settlement services, says bookings are filled until two weeks after the April 30 deadline, and along with walk-in clients, she expects another 500 people looking for tax filing assistance.

"We try to educate and empower newcomers to feel like Canada's home and (make) their life in Calgary much easier," she said.

"Some people are coming from different backgrounds, so the word 'tax' for them means a lot of bad things, not good things, so there is no benefits related to taxes."

She says that results in newcomers not filing taxes and receiving benefits they are entitled to.

El Tanahi says the TIES tax clinic helps clients with eligibility under the government’s definition of modest incomes, and supports clients in Arabic, Spanish, Ukranian, Russian, Dari, Hindi and Tagalog.

She says with the high cost of living in Calgary, every dollar helps.

El Tanahi says returns can range from a few hundred dollars to thousands, and remembers a case of helping a single mother.

"She told me that she's from immigrant parents, so she came here, she never ever filed her taxes for maybe four or five years, and she has three children," said El Tanahi.

"She doesn't even know that there is a child benefit, so she walked out from the office with maybe over $30,000 she is receiving a year, so she was so happy, thrilled about the service."

CTVNews.ca Top Stories

NEW Is there a cost to convenience? Canada approves new cancer immunotherapy treatment

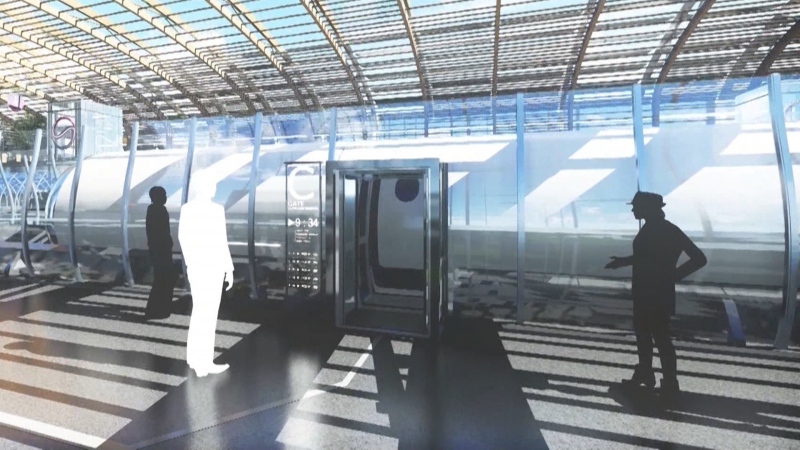

A new cancer treatment recently approved in Canada promises to cut treatment time down to just minutes, but experts have differing opinions on whether it's what's best for patients.

Air Canada walks back new seat selection policy change after backlash

Air Canada has paused a new seat selection fee for travellers booked on the lowest fares just days after implementing it.

Canada's new dental program offering hope of free care to millions but many dentists aren't signed up

A new Canadian dental care program is offering the hope of free care to millions, but while 1.7 million people have signed up for the plan, only about 5,000 dentists have done the same.

Province boots mayor and council in small northern Ont. town out of office

An ongoing municipal strike, court battles and revolt by half of council has prompted the province to oust the mayor and council in Black River-Matheson.

King Charles III returns to public duties with a trip to a cancer charity

King Charles III returned to public duties on Tuesday, visiting a cancer treatment charity and beginning his carefully managed comeback after the monarch's own cancer diagnosis sidelined him for three months.

NDP says Ottawa's new grocery task force isn't living up to government promises

The federal government says the task force it created to monitor and investigate grocery retailers' practices has not conducted any probes and doesn't have a mandate to take enforcement action.

A group of Toronto tenants have been on a rent strike for a year and say there's no resolution in sight

Dozens of tenants in Toronto's Thorncliffe Park area have now been withholding their rent for one year, and it’s unclear when the dispute will end.

U.K. police arrest man wielding a sword in east London, 5 people are taken to the hospital

A man wielding a sword attacked members of the public and two police officers on Tuesday in the east London community of Hainault before being arrested, police said.

Archeologists search for remnants of Halifax's 250-year-old wall that surrounded the city

Archeologist Jonathan Fowler is using ground-penetrating radar to search for historic evidence of the massive wall that surrounded Halifax more than 250 years ago.