Alberta's rural communities say delinquent oil companies need to 'step up'

Vulcan County administrators say oil companies owe them $11.8 million in unpaid taxes.

Vulcan County administrators say oil companies owe them $11.8 million in unpaid taxes.

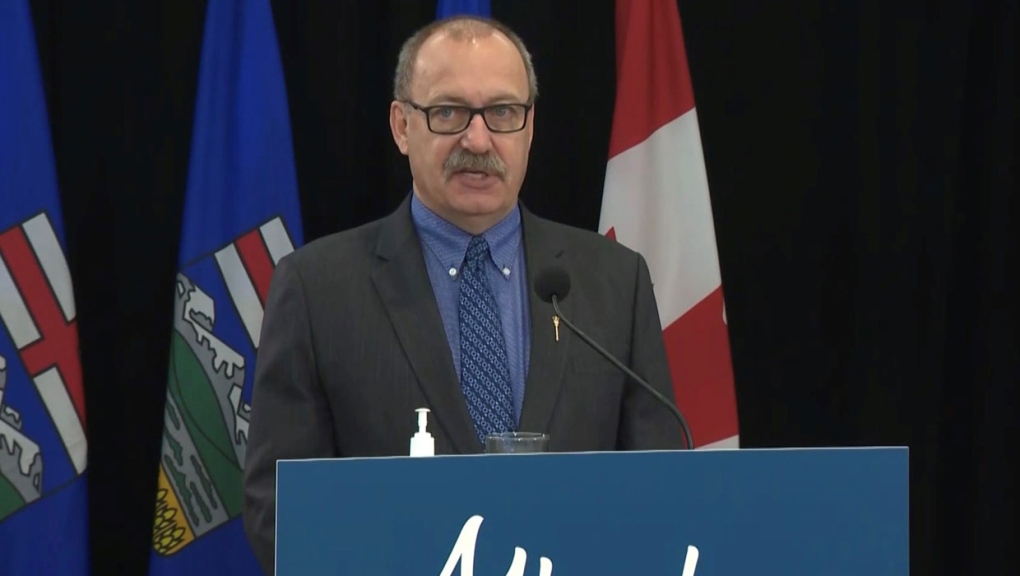

The Alberta government is introducing legislative amendments that it says will help municipalities collect unpaid taxes from oil and gas properties.

Municipal Affairs Minister Ric McIver announced changes to the Municipal Government Act Thursday afternoon.

"This is a hammer," he said.

"I guess you can debate whether it's a medium or large sized hammer but it's definitely a hammer and a hammer that the municipalities need."

The largest change is to restore and clarify a special lien for unpaid property taxes on property, machinery and equipment.

"This legislation is intended to help municipalities go after those companies who refuse to play by the rules," said McIver.

"Bad actors who ignore the rules and don’t pay their taxes force everyone else to fill in the gaps – that’s not fair."

McIver says the amendments will result in several changes that will take effect when they are proclaimed:

- Hold the property owner, and the operator of oil and gas machinery liable for unpaid taxes;

- Create a 120-day redemption period between when taxes are due and when the special lien is enforced and;

- Special liens will apply to all debtor’s property within the municipality.

McIver says this restores a tool that communities lost two years ago after a court ruled that such liens didn't apply to the oilpatch.

The province is advising any company with an outstanding tax bill to contact their local municipality to discuss the changes.

According to a survey sent out by Rural Municipalities of Alberta (RMA), there is currently on overall unpaid oil and gas property tax burden of $245.7 million.

This represents a 42 per cent increase from RMA's 2020 member survey and a 203 per cent increase from 2019.

McIver said the province is willing to go further if the special lien doesn’t prove effective.

"We’re hoping that doesn’t happen,” he said. “If it does, I will certainly have conversations with municipalities and energy companies."

In southern Alberta, Vulcan County is currently facing a unpaid tax bill from oil and gas companies of $11.8 million.

According to the county's Reeve Jason Schneider, this doesn't just leave them picking up the tab, but also the residents.

"Vulcan County is 3,950 people, so it's over $3,000 per resident that is owed in oil and gas and uncollected taxes at this point," Schneider told CTV News.

"If you want to put that into perspective, if that was the same level in the city of Calgary, it'd be $4 billion."

Schneider went on to add that any type of accountability program that helps them get at least some of the debt paid off is welcome and that energy companies need to step up.

"If you want to continue to operate in Alberta as an oil and gas company, you need to pay your taxes," he said.

"I know that there are companies that endure financial trouble, but putting municipalities as a secure creditor would be a step in the right direction."

When it comes to the province as a whole, the RMA says called the new amendments "an important step" towards keeping companies accountable about their tax bills.

“RMA appreciates the government of Alberta recognizing the importance of this issue and looks forward to working with provincial decision makers to ensure that the changes announced today make a meaningful difference for municipalities,” said RMA president Paul McLauchlin.

Municipalities rely on property taxes as a primary source of income and are legally required to balance their budgets, meaning lost tax revenue cuts into services they provide.

The province says between 40 and 60 per cent of unpaid taxes are the responsibility of companies that continue to operate in Alberta, with the remainder belonging to companies facing insolvency.

CTVNews.ca Top Stories

Former homicide detective explains how police will investigate shooting outside Drake's Bridle Path mansion

Footage from dozens of security cameras in the area of Drake’s Bridle Path mansion could be the key to identifying the suspect responsible for shooting and seriously injuring a security guard outside the rapper’s sprawling home early Tuesday morning, a former Toronto homicide detective says.

Federal government grants B.C.'s request to recriminalize hard drugs in public spaces

The federal government is granting British Columbia's request to recriminalize hard drugs in public spaces, nearly two weeks after the province asked to end its pilot project early over concerns of public drug use.

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

Stormy Daniels took the witness stand Tuesday at Donald Trump's hush money trial, describing for jurors a sexual encounter the porn actor says she had with him in 2006 that resulted in her being paid off to keep silent during the presidential race 10 years later.

MPs agree Canadian gov't should improve new disability benefit

The federal government needs to safeguard the incoming Canada Disability Benefit from clawbacks and do more to ensure it actually meets the stated aim of lifting people living with disabilities out of poverty, MPs from all parties agree.

Bye-bye bag fee: Calgary repeals single-use bylaw

A Calgary bylaw requiring businesses to charge a minimum bag fee and only provide single-use items when requested has officially been tossed.

CFL suspends Argos QB Chad Kelly at least nine games following investigation

The CFL suspended Toronto Argonauts quarterback Chad Kelly for at least nine regular-season games Tuesday following its investigation into a lawsuit filed by a former strength-and-conditioning coach against both the player and club.

Boy Scouts of America changing name for first time in 114 years, aiming for inclusivity

The Boy Scouts of America is changing its name for the first time in its 114-year history and will become Scouting America. It's a significant shift as the organization emerges from bankruptcy following a flood of sexual abuse claims and seeks to focus on inclusion.

opinion Tom Mulcair: Trudeau's handling of Poilievre's 'wacko' House turfing a clear sign of Liberal desperation

When Speaker Greg Fergus tossed out Pierre Poilievre from the House last week, "those of us who have experience as parliamentarians simply couldn't believe our eyes," writes former NDP leader Tom Mulcair in his column for CTVNews.ca

New charges for Ont. woman who previously admitted to defrauding doulas

The Brantford, Ont. woman who was previously sentenced to house arrest after admitting to deceiving doulas has been charged again in connection to a new victim.