Inflation 'eroding' the ability of Albertans to buy a home: RBC poll

RBC's Home Ownership Poll found that challenges are continuing to mount for those looking to buy a home amid Canada's heated housing market. (Pexels/Cup of Couple)

RBC's Home Ownership Poll found that challenges are continuing to mount for those looking to buy a home amid Canada's heated housing market. (Pexels/Cup of Couple)

Many Albertans may be looking for a side hustle or to family members to help cover the high cost of housing, a new poll suggests.

RBC's Home Ownership Poll, released on Tuesday, found that continued high inflation is "eroding" the ability of Canadians to purchase a home, especially among those who are looking to buy within the next two years.

"Among these potential buyers, there has been a 37 per cent decrease in the total amount they have saved to put towards buying a home," the poll said.

"Among those who have saved some amount, 36 per cent say they aren’t putting aside money every month for a home purchase (up from eight per cent in 2023)."

- Sign up for breaking news alerts from CTV News, right at your fingertips

- The information you need to know, sent directly to you: Download the CTV News App

When it comes to Alberta, RBC said nearly 58 per cent of residents here are considering a second job or "side hustle" to help afford a home.

More than six-in-10 Albertans are looking to family members to assist them with home ownership, RBC said.

"Financial support from family might not always be an option though with 40 per cent of respondents in Alberta saying they want to give family members money for housing or rent, but can’t afford to do so," officials said.

Home ownership struggles also exist for next-time home buyers; individuals who currently own a home and are looking to buy within the next two years.

RBC said 76 per cent of next-time home buyers in Canada feel the housing market in their community is overpriced and 64 per cent say they won't be able to buy in the current market.

The same proportion of people say they would need to move out of the city they currently live in to afford a larger home.

"Canadians have a lot of headwinds to face as they look to purchase a home today, whether they are a first-time buyer or searching for their next home," said RBC's senior vice-president of home equity finance and newcomer strategy Janet Boyle in a news release.

"While affordability anxiety remains, our research found that many home buyers are exploring different approaches to realize their dream of home ownership."

The poll was conducted online, between Jan. 25 and Feb 23, on a sample size of 2,824 Canadians aged 18 to 64.

For comparative purposes, a probability sample of 2,824 respondents would have a margin of error of +/- 1.8 per cent, 19 times out of 20.

CTVNews.ca Top Stories

TD penalties expected to be higher on alleged drug money laundering link: analyst

A banking analyst says TD Bank Group could be hit with more severe penalties than previously expected after a report that the investigation it faces in the U.S. is tied to laundering illicit fentanyl profits.

DEVELOPING Foreign interference inquiry to report today on alleged meddling in federal elections

A federal commission of inquiry into foreign interference is slated to release a report today on alleged meddling in the last two general elections.

Magnitude 4.8 earthquake recorded west of Vancouver Island

A 4.8-magnitude earthquake was reported west of Vancouver Island Thursday evening.

Biscuits with possible plastic pieces, metal found in ground pork: Here are the recalls for this week

Here are the latest recalls Canadians should watch out for, according to Health Canada and the Canadian Food Inspection Agency.

How falling for a stranger she met on a beach led this woman to ditch the U.S. for the French Riviera

Niki Benjamin, from the U.S., had travelled to a paradise island to do some soul searching, and her life ended up going in a very different direction when her dog ran up to a stranger.

Britney Spears 'home and safe' after paramedics responded to an incident at the Chateau Marmont, source tells CNN

A source close to singer Britney Spears tells CNN that the pop star is 'home and safe' after she had a 'major fight' with her boyfriend on Wednesday night at the Chateau Marmont in West Hollywood.

Princess Anne to take part in B.C. ceremony bringing new ship into Pacific fleet

Western Canada's first Arctic and Offshore Patrol Vessel will officially be brought into the Pacific fleet today and Princess Anne, the sister of King Charles, is scheduled to take part in its commissioning ceremony.

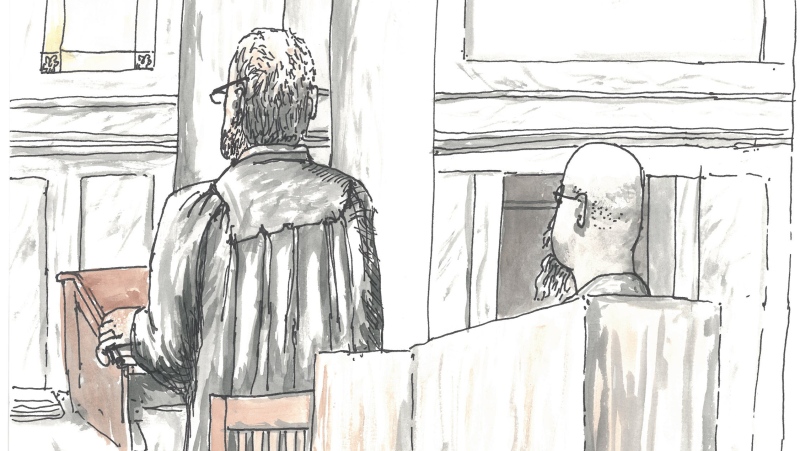

BREAKING Winnipeg man accused of killing four women will be tried by jury

A Winnipeg man accused of killing four Indigenous women will have his case heard by a jury.

Wally, the emotional support alligator once denied entry to a baseball game, is missing

Emotional support animal registrations in the United States reached 115,832 last year, by an industry group’s count. But in the eyes of reptile rescuer Joie Henney, there’s only one: 'Wally Gator.'