New federal Canada Dental Benefit delivered through CRA to improve access to funds: Health Canada

Child gets a dental check up by Dr. Farida Saher in Calgary on Thursday

Child gets a dental check up by Dr. Farida Saher in Calgary on Thursday

Health Canada officials are sharing more details about the rollout of Canada's first-ever federal dental benefit plan, for children under age 12.

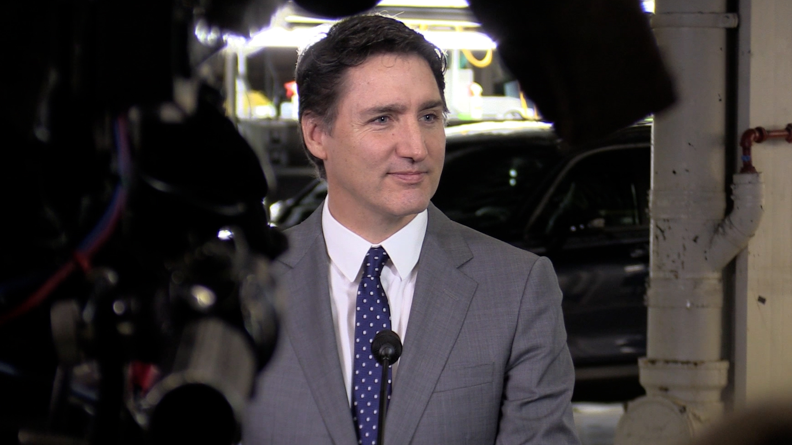

"Many children in low income households are not getting the dental care they need. But as parents we recognize that dental care is an essential part of children's health and well being," said Prime Minister Justin Trudeau during a news conference in London, Ont. on Thursday.

Trudeau estimates it will help half a million Canadian children from low-income households to see the dentist.

As of Dec. 1, the Canada Dental Benefit is open for online applications to the Canada Revenue Agency (CRA) portal or via phone.

The benefit is a tax-free payment provided to families with an adjusted annual income below $90,000 per household, offering up to $650 per child.

More information about the specifics of the plan, including income thresholds, and applicable time periods can be found here.

"The plan was really to be able to get money into the hands of parents even before they actually go to the dentist because we know that some families don't have the money upfront and can't wait for reimbursement," said Marika Nadeau, director general with dental task force with Health Canada.

CLARIFICATION ABOUT DENTAL BENEFIT

Nadeau also provided clarification about the Canada Dental Benefit:

Applicants are not required to return any unused portion of the benefit back to CRA.

Nor are they required to demonstrate or prove dental care was provided, but Health Canada does ask that receipts are kept for six years to as part of post-verification or in case the CRA calls in the future to validate eligibility.

If there is a remaining balance because the costs of dental care was less than the benefit, Nadeau encourages parents and guardians to use those funds towards oral care services or items like toothbrushes or floss.

A previous CTV News story incorrectly stated that funds would be made available in 2023, Health Canada officials have clarified that funds can be transferred into a successful applicant's bank account via the CRA in five business days, 10 -12 for cheque delivery.

Health Canada adds that rolling out the benefit through the CRA ensures applicants meet the income threshold, and other eligibility criteria.

As well, applicants who are currently covered by provincial or territorial programs may still be eligible for the federal benefit "so long as they have out of pocket costs for dental care services -- costs which are not reimbursed under another federal, provincial or territorial government program," said Mark Johnson, spokesperson for Health Canada.

"It's pretty exciting, we all know that poor oral health can lead to a wide range of disease like cancer and cardiovascular disease and other things which can definitely have an impact on children," said Nadeau.

She adds that she is hopeful this benefit will help low-income households access dental care with a Calgary dentist and oral health professional for their children.

The Canada Dental Benefit will be expanded to other age groups and categories in future stages, more details on that can be found here.

Correction

A previous CTV News Story incorrectly explained the application process for the Canada Dental Benefit through the Canada Revenue Agency. We regret this error, and the following story offers a thorough explanation.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Body of Quebec man who died in Cuba found in Russia, family confirms

A Montreal-area family confirmed to CTV News that the body of their loved one who died while on vacation in Cuba is being repatriated to Canada after it was mistakenly sent to Russia.